Why is there "sky-high price" of contemporary art?

Why would anyone be willing to pay hundreds of millions of dollars for a painting?

Why is anyone willing to pay hundreds of millions of dollars for a painting?

Why is anyone willing to pay hundreds of millions of dollars for a painting? This kind of crazy phenomenon is beyond people's imagination. Many people are confused, some are in awe, and others worry that it will arouse the anger of others.

when the turnover of a modernist painting is much higher than that of a rarer and older work of art, the standard of the reason is powerless. In the early years, paintings by the 17th-century Dutch painter Johannes Vermeer sold for $14.5 million, but that was only 1/10 of the price of Jackson Pollock's work No. 5. In terms of auction turnover, neither Monet nor Rubens, Max Beckmann, or Joseph Mallord WilliamTurner can compete with contemporary artists such as Damien Hirst or Maurizio Cattelan.

the latest art market boom began in 2003 against a backdrop of a global liquidity glut and Wall Street bankers becoming collectors with large bonuses. One of the highlights of the influx of money was the 2004 Picasso painting Boy with a Pipe, which was sold by Sotheby's in London for $104 million, setting a new world record for a painting. However, the market did not stop there. Works by Andy Warhol, the iconic pop art figure, and Jeff Koons, a former Wall Street stockbroker, have all soared to tens of millions of dollars. From 2005 to 2008, the contemporary art price index rose 67%, outpacing the stock market over the same period (the Dow Jones rose 24.5% over the same period).

the material cost of contemporary artworks is low, and for speculators, compared with expensive jewelry, there is no room for contemporary art to produce surplus value. For reason, it is difficult to understand how there is such a wide gap between the cost of production and the price of products. Art is divorced from reality, and all earthly standards seem to not affect it.

the appreciation of works of art in the alternation of ownership is impressive. People are happy to tell the story of a lady who bought a nylon lamp by the British art duo Timnobe and Tim Noble & Sue Webster entitled "Happy" for $2000 and later sold it for $10,000, but the lady missed the work so much that she bought it back for $100000 two years later.

many collectors are no stranger to this game of switching between buying and selling, resale, profit, loss, speculation, estimation, and feeling, and they have learned the game in the stock and stock markets.

most of these big collectors themselves are successful capitalists. They regard art as another form of money. This is not hard to explain why many securities traders also show up at art fairs and auctions, and their job is to convert hedge funds into ornamental assets.

Contemporary art is the new toy that millionaires love. After they own horse racing, rowing, and car racing, they launch games around art. Steven A.Cohen, a hedge fund manager, bought Damien Hearst's "shark art" for what he thought was a cheap price of $12 million. But even for an expert like him who knows venture capital like the back of his hand, such a decision still depends on the assertions of others-- it's the same as stocks, and the stock doesn't grow just because the company is doing well. but because many people believe that the company will do better in the future. "A lot of people place orders before they see the work, and some of the works are sold before they are created," said Konrad & nbsp; O.Bernheimer. People admire such a creed: the work that everyone likes must be good. "

Art is also too happy for people to understand, but it is not difficult to understand a work of art, and it will be much easier when its price is determined-so there is a rare tension between this difficulty and understanding. Everyone can understand what the price is, and over time, the complex art problems are rooted in the market.

artists are gathered together by galleries and auction houses, gradually abandoning traditional dominant values, aesthetics, or skills, but thanks to money, there is a unified standard for very different works of art.

this can also explain why art fairs and auctions are becoming more popular than any other art trade here. Everything else is much smoother. The volume of transactions in the small stalls of the art fair far exceeded the sales in their galleries. The era of low-key has passed, works of art no longer pursue a quiet and beautiful environment, but pursue the noise in the market, and art dealers have come to the stage from behind the scenes in the past.

but how did all this happen?

Let's return to the reality of society and think about the "excessive accumulation" of capital and the "underconsumption" of the masses. The fundamental problem of the economic crisis is still the "crisis of realization". With the progress of production efficiency, the share of public wages in the total income is declining, and due to the overproduction caused by "insufficient consumption", capitalists face the risk that the surplus-value is difficult to be realized. In modern times, this risk is mitigated by such financial behavior: (1) adjusting the imbalances in global markets; (2) encouraging the average household to support consumption with excessive debt; and (3) transferring money that has not been reinvested to the high consumption of the elite social class, thus the imaginary sky-high price of art appears.

the economic crisis of commodity surplus is bound to result in a reduction in reinvestment. When profits fall to a certain extent, only a sufficient amount of capital can be let go bankrupt. Fearing the social and political unrest caused by a large-scale capital collapse, the current capitalism does not dare to destroy the excess capital through the economic crisis. Although the active intervention of the government avoids the threat of a large number of capital bankruptcy, it also loses the ability to restore profit margins at the expense of some capital. To avoid being suffocated by fluctuations, Kidron said: capitalism is already a "hardened" system.

"profit margin declining trend theory" is the core of Marxist economic crisis theory. In the United States, capitalism has suffered great difficulties in making profits since the late 1960s, capitalism has encountered a "black hole", and it has failed to restore profit margins through capital restructuring. "A paradoxical reality is that once capital comes into contact with real production, profits are hard to be seen." profitable investment sites are limited in the 'real' economy." When the profit margin of "productive labor" falls to an unbearable level, the "speculative investment" of capital appears one after another.

in the United States, the repeal of the Deposit institutions deregulation and Monetary Control Act of 1980, the Gunn-St. Germain savings institutions Act of 1982 and the Glass-Steagall Act of 1999 paved the way for the speculative expansion of financial markets.

in the current global transactions, physical transactions account for only 4% of the total currency transactions, and a large amount of money in circulation is deposited in the financial barrier lake. These risky financial speculations are mainly in hedge funds, stock markets, financial derivatives markets, dot-com bubbles, and real estate bubbles. Virtual profits have been generated, profit margins have been raised, and the real average profit margins have been masked. The capitalist economy has become a virtual gambling economy.

Marx's theory of "unproductive labor" holds that productive labor is labor that creates surplus value by expanding production, while unproductive labor is simply distributing, protecting, or wasting existing output. In the United States today, "unproductive workers" account for more than 60% of the working population. These "unproductive labor", which do not create wealth, are another consumption of surplus value and profit margin and use invalid labor to produce invalid wealth. The fictitious economy which is separated from the entity gives the capital a space to expand. The fictitious economy expands the control power of capital and controls the flow of wealth and resources, which is naturally an opportunity for capital. However, for human society, it is the most ineffective and harmful.

in 2000, the European Association for Cultural Development invested countless funds in emerging exposition projects, and the new marketing strategy meant a huge amount of additional capital consumption. The Fritz Art Fair in London has a lot of powerful sponsors behind it, and the amount of money is amazing. Deutsche Bank of Germany has also shifted its investment interest from department stores to the art market. Some financial oligarchs have become the main buyers. Chase Manhattan Bank has so far collected 12000 works of art.

Why are financial markets so attractive to art? What kind of profound influence does it have on art? On the other hand, no other field shows the urgency and stubbornness to eliminate all boundaries like art.

Matthias Witchell (Matthias Weischer) has never shown his work. He is famous because his work sold for $384,854 at an auction. Only when the work is sold at a high price will more and more people become interested. It is not surprising that only beautiful paintings. Only a work sold at an astonishing price is a good painting.

the power of economy exceeds that of aesthetics. Decisions on the quality of works of art are handed over to the market. Those who make the most money are more trustworthy in their judgment of quality. A gallery with good business is an excellent gallery; what you buy in an excellent gallery is excellent works of art-and quantity becomes the embodiment of quality. When ArtTactic, a market research company, analyzes painters, it is not about the content of their paintings. The data analyzed relate only to the usual price of their work, the auction price records, collectors, galleries, and managers, based on these statistical analyses to judge whether an artist is good or not. "the most expensive work is the best," asserts Tobias Tobias Meyer of Sotheby's auction house Sotheby. He believes that although there are many ways to judge, it is the most reliable to judge by the results of the auction.

the price of a work of art is based on its true value. It is hard not to expose the Emperor's New Clothes. Yeshe research on the value theory of works of art. In addition to its intrinsic value, a work of art. Now it has external value. The external value of works of art can be described by an A-B-C formula & nbsp;A represents art (art), art (art-work) or artist (artist); C represents consumers or consumers (consume, consumer), especially art collectors or collectors (collection, collector); the middle B represents merchants and art transactions (business).

art has formed a complex market chain, such as auction house-gallery, publishing, printing, exhibition, and so on. That is to say, there is more than one B between An and C. The simple formula of this A-B-C should be extended to A-B-b1-b2-b3. -bn-B-Cs; where each lowercase b represents an enterprise or a business activity, some lowercase b is likely to be media (from broadcast to broadband), while others may be traditional industries The s after C represents a much larger plural than A., some collectors are also an enterprise, and they get display and related management rights from the auction house: it refers not only to a large number of consumers but also to the superposition of consumer content. The infinite expansion of B reflects the degree of art industrialization, while the richness of B shows the characteristics of mutual promotion, operation, and contrast among related industries. These are the macro situation of the modern art business model.

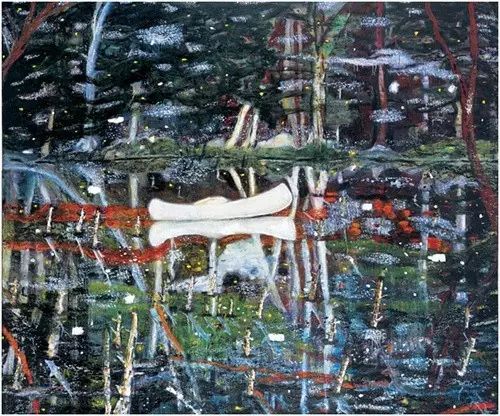

the market has taken over the domination of art. Incredibly, the art market is not a formal market at all. They just need some managers, some important collectors, and consultants, who claim that art is just part of the business chain. The price of a painting will increase several times in a few minutes. In February 2007, Peter Doig's 1990 White Canoe ("White Canoe") sold for an incredibly high price of $11.3 million. Sotheby's (Sotheby & # 39) expects to fetch no more than $2.3 million.

Peter Doig, "White Canoe", 1990

in art, the core values of capitalism are integrated with artists. They represent innovation and creativity. They are inspired and can always find new market gaps and fill them with works that have never appeared before. The value of their "products" can be evaluated repeatedly, and there is plenty of room for value-added over time.

artists are completely free to perform on this almost utopian, unrestricted market stage. The disorder is the guarantee of commercial value. The less assessment of quality, the better. Any rules and restrictions conflict with their ideals of freedom. This is the most in line with the market imagination, the ideal state of the artist.

the creative process of artists' works is also different from that in the past, and they often, like managers, "produce" their works according to the law of acquisition. They collect existing paintings or ready-made objects, and alter and assemble them into their works, which they call "Ready-made". Many entrepreneurs can see the similarities between this method of artistic innovation and business management. Unrestricted contemporary art means a completely open market to them.

as part of the world system, it seems that only China's economy is still making a huge productive investment; in this regard, (socialist) China is seen as the savior of the entire capitalist system. China's capital can add more surplus value (more than 40% of national output) to investment and has not been dragged down by "unproductive spending". This also makes China a major competitor in the world export market.

for Chinese contemporary art, if the "avant-garde art" in the 1980s is only self-expression of liberalism, then Chinese contemporary art is now at the forefront of marketization and financialization. Chinese contemporary artists have become the target of the market. In the spring auction of Sotheby's in New York in 2006, Zhang Xiaogang's "consanguinity Series: comrade 120th" was sold by Singaporean buyers for more than twice the estimated price of $979200, taking the lead in approaching a million dollars. As of June 2008, the number of Chinese contemporary artists who have joined the million-dollar club has increased to 18. Over the past decade, the prices of works by Chinese avant-garde artists have risen by 1050%.

Give yourself a fantastic feeling by opting for our stylish crop top wedding dresses. Consider these fabulous collections.

in history, works of art have never been far away from the purchasing power of the people. of course, questions such as why there are "sky-high" works of art are still related to the consumption pattern of society. Sky-high prices can only be established in a society with mallet-shaped wealth distribution. However, this is also the current situation of wealth distribution in Chinese society, which can be explained. Why Chinese contemporary art has been selected into the "sky-high price" club of art.

Ref. Kapoks translation, Hanno Rauterberg.Und das ist Kunst? Is this art?